Atradius Modula Trade Credit Insurance Policy

Atradius Credit Insurance helps protect your business against credit risks such as the insolvency of your customers and is tailored to your specific business needs.

Australia

Australia

Atradius Credit Insurance helps protect your business against credit risks such as the insolvency of your customers and is tailored to your specific business needs.

Our Trade Credit Insurance, also known as debtor insurance, helps protect your business from losses that may be caused by the failure of a customer to pay. It is designed to enable your business to trade on credit with confidence and explore new markets or products, knowing that you’re protected against credit risks.

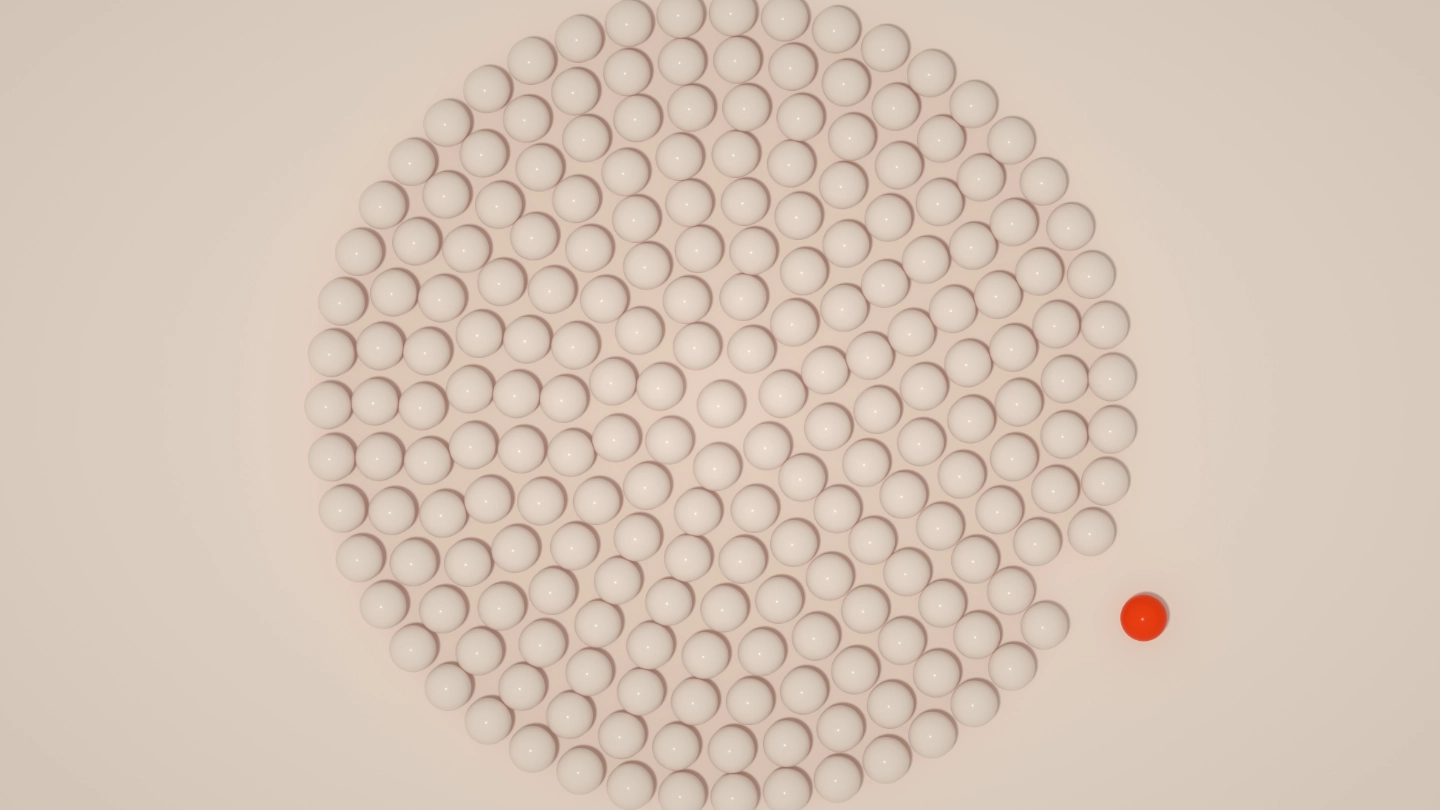

Atradius Modula is a risk management tool that allows you to build a trade credit insurance policy to your specific business needs. It is a uniquely flexible solution to structuring bespoke cover for credit based trade, ensuring that your business has all the credit insurance it needs, without paying for cover that it doesn’t.

Using Atradius Trade Credit Insurance can provide your business with increased access to finance, as we can provide your bank with the reassurances they need when extending finance to you.

It can also support you in defining your strategic pathway, through identifying opportunities as well as risks as well as help with a healthier balance sheet through a reduction in the need for bad debt provision.

Credit Insurance is a safety net that provides you with further opportunities for growth, as it enables you to test new markets and products, safe in the knowledge that you’ll be protected against trade credit risk and bad debt.

The only certainty in business is uncertainty. When selling on credit terms, there’s always a risk that payment may not be made on time – or at all . Risk is an inherent part of credit based trade. It does not matter how well you know your market and buyers – insolvency and payment default are commercial realities. Even though you may have dealt with your buyer or buyers for many years, or if they are one of the biggest brands in the market, you cannot predict the future.

Now with trade credit insurance from Atradius you can protect your business from bad debt and focus on growing your business. Whether you’re looking at increasing profits or entering new markets, you can now do so with confidence and leave the payment worries to us.

If you would like to find out more about how credit insurance can help your business to reduce your trade credit risk, drop us an email or give us a call, we would be glad to help.

Modula

Insurance against risk of non-payment as a result of your customer’s insolvency or inability to pay

Cover for domestic and export trade

Cover based on ‘building blocks’ which can be extended to risks outside your customers’ control such as currency exchange problems, war,

As the policy is tailored to your specific requirements, it is as cost effective as possible

Simple administration: with clear pricing, online policy management and expert support always available, you can focus on your business, not