ICT continues to be characterised by stiff competition and cheap imports causing pricing pressures, especially for smaller IT resellers and distributors.

- IT and IT Enabled Services (ITES) are key driving forces fuelling economic growth. They contributed 7.9% to India’s GDP in 2018. The main segments of the industry are IT services (42% share), Business Process Management (16%), Engineering R&D and packaged software (16.%), hardware (7%) and e-commerce (19%).

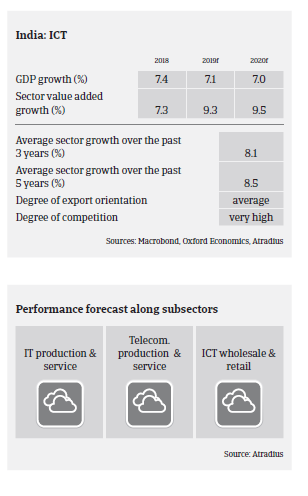

- The industry grew 9.4% to USD 204.5 billion in the financial year (FY) 2018, and another 9.5% increase is expected in the FY 2019. Key drivers are robust economic growth, growing disposable income, penetration into rural markets, tier 2 and tier 3 cities, the e-commerce boom, and government investments in the industry.

- Despite the healthy growth rates the industry continues to be characterised by stiff competition and cheap imports causing pricing pressures, especially for smaller IT resellers and distributors, who are working on very low margins.

- On average, payments in the Indian ICT sector take 90 to 120 days. The increasing presence of online retailers puts pressure on brick and mortar IT resellers and distributors. In H2 of 2018 several ICT resellers went on strike to protest the predatory pricing of e-commerce businesses. This resulted in slow moving stock and delayed payments. We are also witnessing stretched payments on government projects.

- Our underwriting stance is neutral for IT production and services. This subsector comprises many large corporates with sound financials, and business prospects remain favourable due to more public IT projects. However, many businesses are exposed to extended working capital cycles, coupled with late payments from government bodies. The tightening of US H-1B visa issuances is putting pressure on Indian IT services firms, as an increase in compliance and on-site hiring impact margins.

- For the telecommunication segment our underwriting stance is restrictive. While mobile-phone penetration and internet usage are sharply increasing, competition is fierce (e.g. from Chinese mobile-phone producers) and prices are under pressure, with little or no product differentiation. A consolidation process is ongoing in the market.

- We are neutral on the ICT distribution and retail segment, as this sector comprises many small businesses (mostly proprietorship/partnership companies) and is characterised by fierce competition and price pressure. Many players hold only a moderate financial risk profile with thin margins and limited or no value addition.

Related documents

1.13MB PDF